On next Thursday the 2014 World

Cup will kick off in Sao Paulo. But next week will also see the FIFA members meeting on Tuesday and Wednesday at a

much awaited FIFA congress. For this special occasion we decided to review

FIFA’s financial

reports over the

last ten years. This post is the first of two, analysing the reports and

highlighting the main economic trends at play at FIFA. First, we will study the

revenue streams and their evolution along the 2003-2013 time span. In order to ensure

an accurate comparison, we have adjusted the revenues to inflation, in order to

provide a level playing field easing the comparative analysis over the years

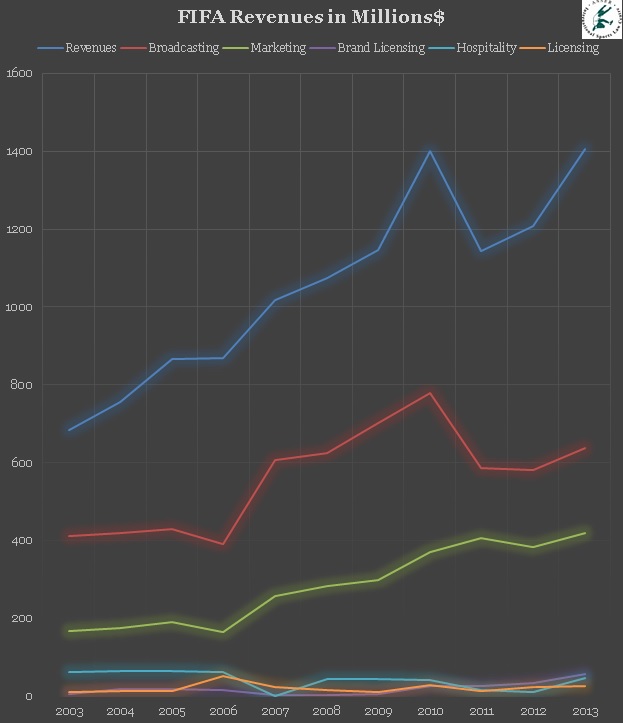

and types of revenues. Our first two graphs gather the main revenue streams

into two comparative overviews. Graph 1 brings together the different types of

revenues in absolute numbers, while Graph 2 lays down the share of each type of

revenues for any given year (the others category covers a bundle of minor

revenue streams not directly relevant to our analysis).

Graph 1: FIFA revenues

in Millions of Dollars, 2003-2013 (adjusted for inflation).

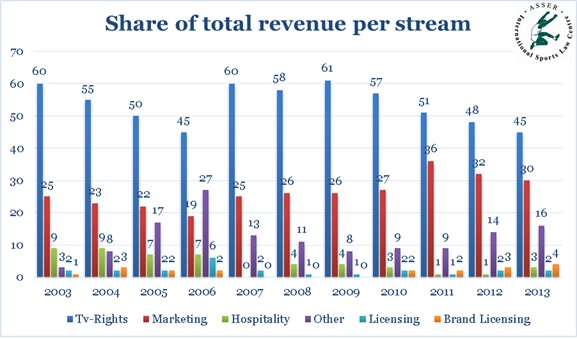

Graph 2: Share of each

revenue stream in Total FIFA revenues 2003-2013

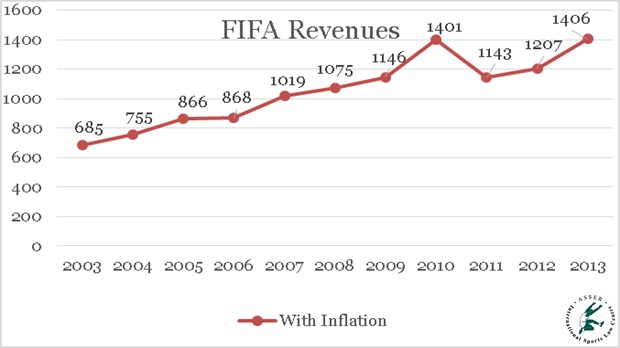

Since 2003, FIFA’s total revenues have more than doubled, from 685

Million$ to 1406 Million$. Its constant growth over the last decade turned

negative only in 2011 and 2012 due to a fallout in broadcasting revenues (see

below Graph 4). In terms of economic power this means that FIFA has doubled its

financial capacity within ten years. It

has succeeded in developing new income streams, while also consolidating its

traditional source of revenue: broadcasting rights.

Graph 3: Total FIFA

revenues in Million$ 2003-2013 (adjusted for inflation)

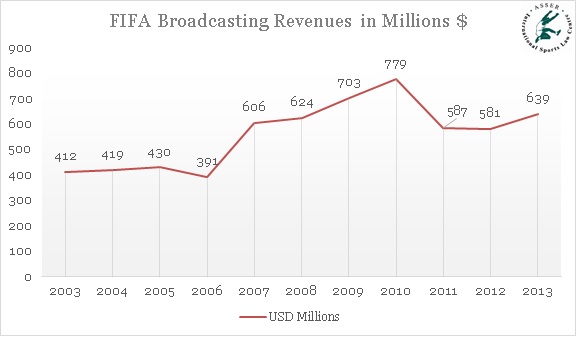

Key to FIFA’s continuous enrichment were the broadcasting revenues. From

2006 to 2010 they nearly doubled from 391 Million$ to 779 Million$. A huge 100%

jump! Since this peak, revenues have settled for a more modest amount of around

600 Million$, but still much higher than at the turn of the century. In any

given year the broadcasting revenues represent 40 to 50% of FIFA’s total

revenues. Thus, one can understand the paramount importance of broadcasting

rights for the economic stability and health of FIFA. The progressive bite of

the revised TV without frontier

directive of the

EU (revised in 1997), enabling countries to define certain World Cup games as “major

events” which therefore must be broadcasted freely, might explain the recent

fall in broadcasting revenues. In this context, recent decisions of the EU Courts, in

cases T-68/08, C‑205/11 P and C‑204/11 P reinforce the rights of the Member States to

make use of the “major events” listing, this could, on the long run, limit the

rise of the broadcasting revenues for FIFA.

Graph 4: FIFA

Broadcasting Revenues 2003-2013 (adjusted to Inflation)

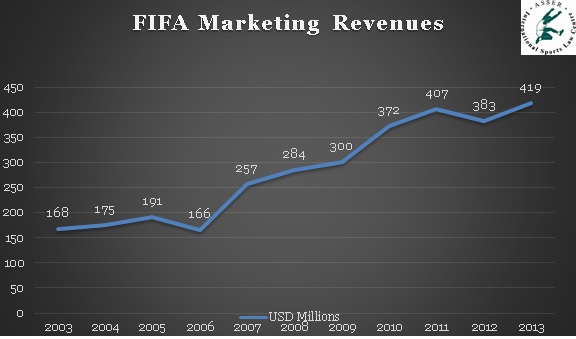

The marketing rights (see graph 5) constitute the second leg

of FIFA’s financial income stream. They have been constantly growing since

2003. From 168 Million$ in 2003 to 419 Million$ in 2013, reaching quasi 150%

growth (at constant prices). In recent years, this has been a more dynamic revenue

stream than broadcasting rights, but it has remained less important in absolute

terms. It seems that the FIFA Partners Programme launched by FIFA, probably inspired by the TOP Programme created by the IOC, is a tremendous success. Nowadays,

marketing rights constitute 30 to 35% of FIFA’s total revenues. Together,

broadcasting revenues and marketing rights amount to a staggering 75 to 85% of

FIFA’s total revenues. A share which remained more or less stable over the

latest years (see Graph2).

Graph 5: FIFA Revenues

from Marketing rights 2003-2013

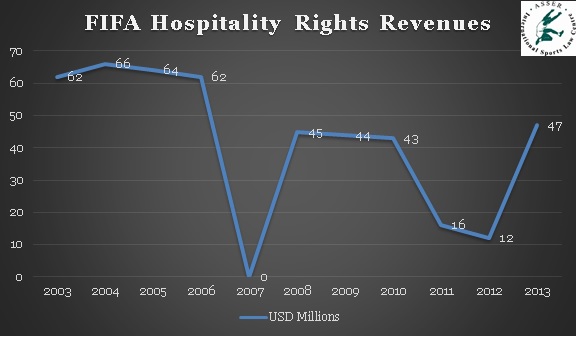

The rather minor revenue streams are constituted by the FIFA hospitality

rights, licensing and brand licensing revenues. Hospitality rights revenues (Graph

6) are a relic from the past. They derive from the profits made by MATCH Hospitality, the sole company authorised by FIFA to offer

and guarantee exclusive hospitality packages for every match of the FIFA World

Cup directly or through its appointed sales agents. With the competition of

internet-based travel agencies and the evolution of the ticketing system of

FIFA under the pressure of the

European Commission, the revenues of match hospitality have been dwindling over the last 10

years.

Graph 6: FIFA

Hospitality Rights Revenues 2003-2013 (adjusted for inflation)

The FIFA licensing

programme (Graph

7) derives its revenues from fixed royalty payments and variable profit shares

paid for the use of the FIFA brand. FIFA’s licensing programme covers a broad

range of activities, including for example numismatic and philatelic collections

and the more classical retail & merchandising. After a peak at the World

Cup 2006 in Germany, where FIFA licensing brought in 51 Million$, licensing

revenues have remained more or less stable averaging at 10 to 20 Million$ a

year.

Graph 7: FIFA

Licensing Revenues 2003-2013 (adjusted for inflation)

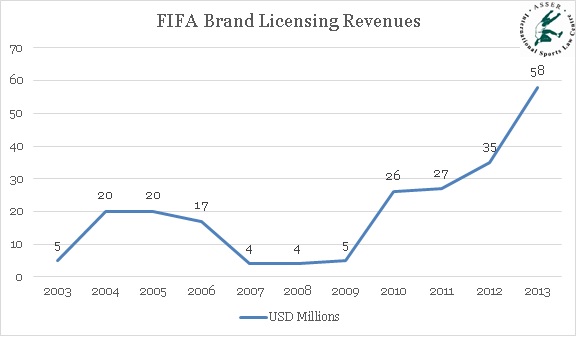

Another closely related, but distinct for accountancy purposes, income

stream, is the one generated by brand licensing (Graph 8). Five companies dispose of a

specific agreement with FIFA: Adidas, Electronic Arts, Hublot, Louis Vuitton

and Panini. Each of these companies holds a licence to use the FIFA Brand Marks

in the advertising, marketing, promotion and sale of its licensed products or

programmes. These long-term licensing agreements bring in more and more money,

from 5 Million$ in 2003, to 58 Million$ in 2013. The biggest jump for a

category of FIFA revenues. Its success

is exemplified by the world-wide fame of the eponym Electronic Arts video game:

FIFA. However, all three revenue streams amount to less than 10% of FIFA’s

total revenues in 2013, the lion share is still constituted by the broadcasting

rights.

Graph 8: FIFA Brand

Licensing Revenues 2003-2013 (adjusted for inflation)

Conclusion:

Get rich and die getting richer?

Economically the last 10

years have been a phenomenal success for FIFA. Its revenues have grown

substantially and it has, to some extent, managed to diversify its

revenue streams. Indeed, FIFA is less and less dependent on broadcasting

revenues, while relying more and more on marketing and brand licensing income

streams. This diversification appears judicious as the broadcasting market seem

to be losing steam, especially in light of a public will, at least at the

European level, to control and tame the monopoly of FIFA over the broadcasting

of the World Cup. Thus, FIFA is in a paradoxical situation. It will enter its

congress engulfed in an unending governance crisis, but financially it looks as

profitable as ever. In some way the big leap forward of FIFA’s recent, and

highly successful, commercialization might cause the existential crisis it is now

confronted with. Indeed, all this fresh money influx may have destabilized even

more a governance system prone to favour nepotism. Hence, the paradox might be

that FIFA got rich and might die (at least as we know it) because of it. This

is also connected to the way FIFA distributes the revenues it collects, which

will be the focus point of the second part of this blog series.